What Actually Happens During an ICO?

You’ve seen the headlines: “Token Sale Goes Live,” “ICO Raises $5 Million in 48 Hours,” “Mint Now!” But what’s actually happening under the hood when someone buys a token during an ICO?

Let’s break down the process in simple terms—from clicking ‘Buy’ to minting tokens and allocating funds.

Step 1: The Smart Contract is Deployed

Before the ICO even starts, developers create and deploy a smart contract on the blockchain (usually Ethereum or BNB Chain). This is the brain of the operation. It defines:

- The total token supply

- Price per token

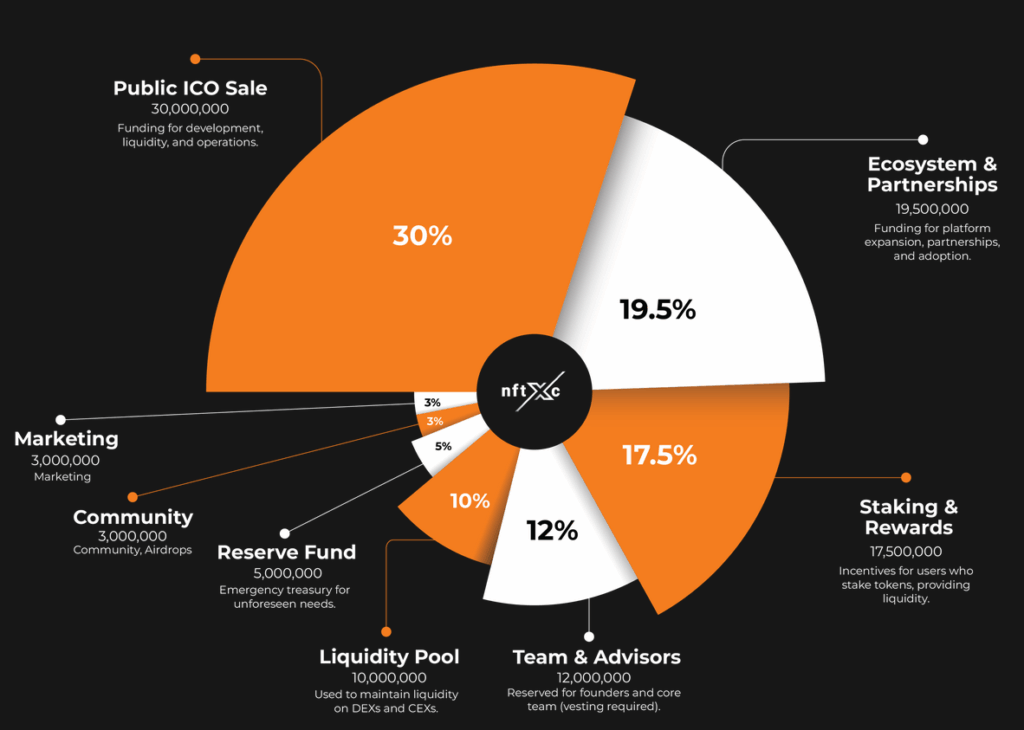

- Allocation rules (e.g., how many tokens go to the public vs. the team)

- Vesting schedules (for team or advisors)

- Fund collection and distribution logic

Once it’s live, it can’t be changed. It’s the digital version of “set in stone.”

Step 2: You Send Crypto, the Contract Responds

When you participate in an ICO, you send crypto (like ETH or BNB) to the smart contract address.

What happens next?

- The smart contract detects your transaction

- It checks if the sale is open, and if you’re eligible (some sales have whitelists or caps)

- If approved, the contract automatically:

- Mints your tokens (creates them just for you)

- Sends them to your wallet

- Records the transaction on-chain (fully transparent and verifiable)

It all happens within seconds—no banks, no middlemen, no paperwork.

Step 3: Token Minting & Distribution

There are typically a few pools or categories:

- Public Sale Tokens: These go to buyers immediately

- Team Tokens: Usually locked (vested) and gradually released over time

- Reserve/Marketing/Rewards: Held in the contract or sent to specific wallets for platform use

The contract ensures everyone gets what they’re supposed to, based on predefined logic. No trust needed—just code.

Step 4: Fund Allocation

All the crypto that was sent to the contract (your ETH, BNB, etc.) is automatically distributed according to plan:

- A portion might go straight to the project treasury wallet

- Some may be locked in a liquidity pool (to ensure trading can happen after launch)

- Developer, marketing, or legal funds may go to other designated wallets

In many cases, the smart contract even locks up a portion of the funds until a future date—ensuring accountability.

Bonus: Liquidity and Exchange Listing

Once the ICO ends, a portion of raised funds and tokens are often used to create liquidity pools on platforms like Uniswap or PancakeSwap. This allows early buyers to trade their tokens—and sets the stage for market activity.

TL;DR – ICOs Simplified

An ICO is basically a smart vending machine:

- You put in crypto

- It checks the rules

- It gives you tokens

- And it tracks everything on-chain

The beauty of it? No human needs to touch the process. Everything is automated, auditable, and secure—as long as the smart contract is written correctly.

ICOs may seem like magic from the outside, but under the hood, it’s smart contract logic doing all the heavy lifting—executing a fundraising playbook with speed, transparency, and trustless precision.

Leave a Reply