From the Book “Minted” by Stephen Steinberger

Chapter 15: Who Makes Money? Understanding Currency Then and Now

Before we dive further into digital currencies like $nftXc, it’s worth stepping back and asking a surprisingly simple question:

Who gets to create money—and why does it matter?

From Barter to Bills

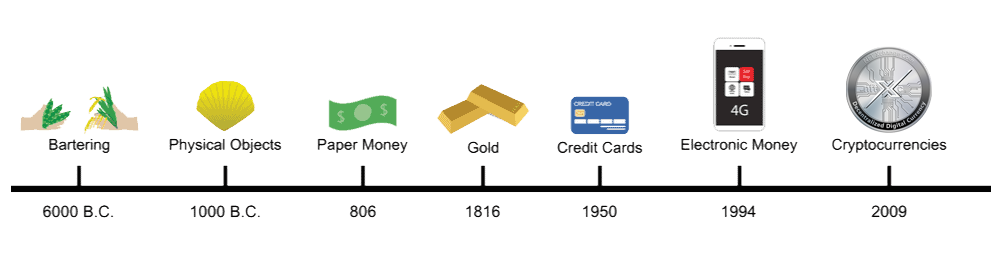

Long before dollars, euros, or yen, people traded goats for grain. Value was physical, immediate, and local. But barter didn’t scale well—you couldn’t easily split a goat or store your grain for long.

So societies developed currency—first in the form of shells, metal coins, and eventually paper backed by precious metals like gold or silver. These forms had two things in common:

- Scarcity: You couldn’t just print more gold.

- Trust: People agreed it had value.

Enter: Fiat Currency

Today’s global currencies—like the U.S. dollar or the euro—are known as fiat money, which means they’re not backed by physical commodities. Their value comes from government decree and public trust.

That trust is enforced by:

- Central banks (like the U.S. Federal Reserve)

- Legal frameworks

- Economic policy

But there’s a catch: governments can print more fiat money. In times of crisis, they often do. That’s how stimulus checks happen. But it’s also how inflation happens—when too much money chases too few goods.

So while fiat currencies have scale, they can also be unstable, politically influenced, or unequally distributed.

Then Came Bitcoin

In 2009, Bitcoin emerged with a radical idea:

“Let’s build a currency with no central authority, no printing press, and rules written in code.”

It launched the era of cryptocurrencies—digital money that anyone can use, no bank account required. Anyone with technical knowledge (or the right tools) can now create a token with:

- Defined supply (fixed or inflationary)

- Transparent rules (smart contracts)

- Global transferability (internet-based wallets)

This was a breakthrough not because Bitcoin replaced the dollar, but because it gave people a choice—and a toolkit.

So… How Do You Make a Coin?

Creating a token like $nftXc involves:

- Writing a smart contract (usually on Ethereum or Binance Smart Chain)

- Setting rules (supply cap, distribution model, permissions)

- Deploying it to the blockchain

- Optionally attaching utility to it—like powering a platform

With tools like PinkSale or Uniswap, even indie creators can launch coins. But launching is easy. Building trust, adoption, and utility? That’s the real challenge.

Why This Matters

Understanding the roots of money helps answer why crypto matters at all:

- Fiat money is powerful, but centralized.

- Crypto is programmable, borderless, and inclusive—but only if designed well.

- Tokens like $nftXc are trying to serve specific ecosystems, not replace the dollar.

It’s not a war between old and new—it’s a choice between different tools for different purposes.