What Is a Crypto Bridge and Why Does It Matter?

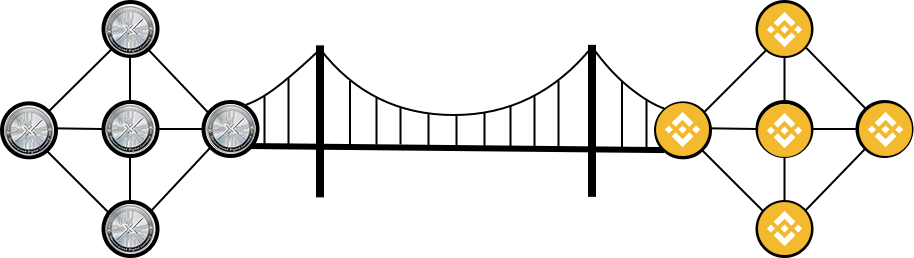

In the rapidly expanding world of cryptocurrency, blockchains are like islands—each powerful in its own right, but isolated. Ethereum, Binance Smart Chain (BSC), and Polygon all have thriving communities, but they don’t speak the same language by default. That’s where crypto bridges come in.

What Is a Crypto Bridge?

A bridge in crypto is a technology that allows digital assets or data to move from one blockchain to another.

Imagine you hold a token on Ethereum, but want to use it on Polygon, where fees are lower and NFT activity is higher. You can’t just send your Ethereum token to a Polygon wallet—that would be like trying to use a MetroCard in a taxi. You need a translator, a connector—a bridge.

How Does It Work?

Most bridges follow a lock-and-mint model:

- Lock: You send your token to a smart contract on Blockchain A (e.g., Ethereum).

- Verification: The bridge confirms your transaction.

- Mint: An equivalent token is minted or released on Blockchain B (e.g., Polygon).

You now hold a “wrapped” version of your token on the second chain—fully usable within that ecosystem.

Later, if you want to move your asset back, the bridge burns or locks your Polygon version and unlocks the original on Ethereum.

Why Do Bridges Matter?

Bridges make interoperability possible. Without them, the blockchain world would remain siloed, limiting users and developers alike.

Here’s what bridges unlock:

- Lower Fees: Move assets from high-cost networks (like Ethereum) to cheaper ones (like BSC or Polygon).

- More Utility: Use the same token across DeFi platforms, NFT marketplaces, and games—even if they’re on different chains.

- Expanded Reach: Projects can attract users from multiple ecosystems, not just one.

Are Bridges Safe?

Like any crypto tool, bridges carry risks. Some are custodial (run by centralized services), while others are decentralized (smart-contract-based). Hacks have occurred, but newer protocols like LayerZero and Polygon’s native bridge are raising the bar for safety.

As always, users should:

- Use verified bridges

- Double-check network and contract addresses

- Be cautious with large transfers

Real-World Example: NFT-TradingCards.biz and $nftXc

Our platform, NFT-TradingCards.biz, runs on Polygon to keep gas fees low for creators and collectors. However, the $nftXc token is launching on Ethereum via a PinkSale fairlaunch.

How do we connect the two?

A bridge allows users to transfer their $nftXc from Ethereum to Polygon—so they can use it to mint, trade, and collect NFT cards. It’s the connective tissue that powers a truly cross-chain experience.

Final Thought

Crypto bridges are more than a convenience—they’re a fundamental step toward a connected blockchain ecosystem. They break down walls, unlock new possibilities, and allow users to go where the opportunity is.

As Web3 evolves, bridges will only become more important. Just like in the real world, the best roads are the ones that connect.