How Stablecoins Are Changing Lives

While most headlines focus on crypto volatility and NFT speculation, a quieter revolution is happening in parts of the world where access to banks is limited, unreliable, or outright nonexistent.

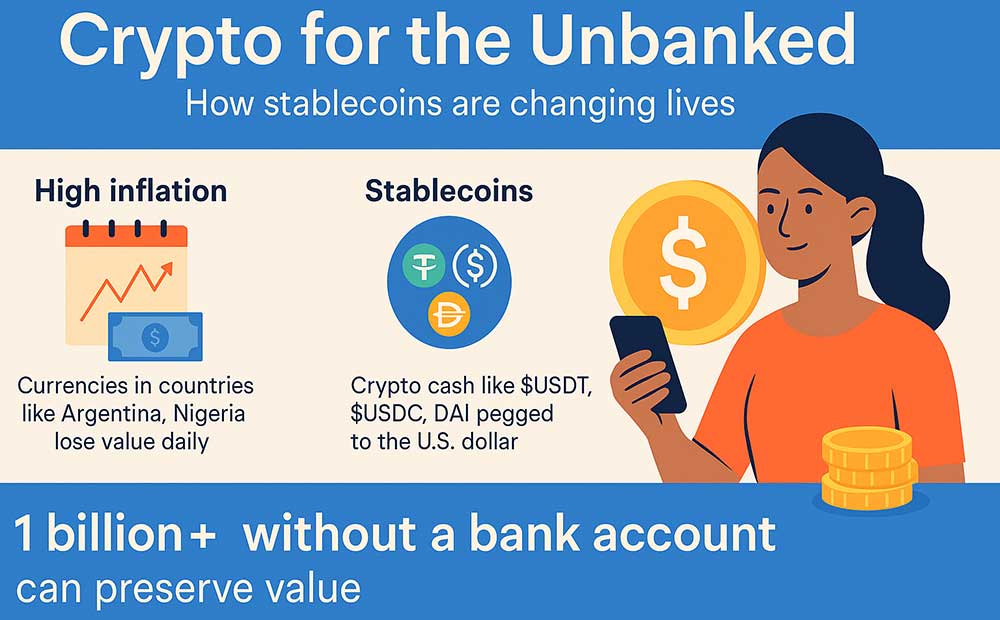

For over 1.4 billion unbanked people globally, crypto isn’t a luxury — it’s a lifeline.

Stablecoins in High-Inflation Economies

In countries like Argentina, Venezuela, Nigeria, and Turkey, traditional currencies often lose value daily. Inflation rates can spike into triple digits. Saving money in the bank? Risky. Storing cash at home? Worse.

That’s where stablecoins — like $USDT, $USDC, or $DAI — come in:

- Pegged to the U.S. dollar

- Immune to local currency collapse

- Instantly accessible via smartphone

- Can be stored in non-custodial wallets, no ID required

For people living paycheck to paycheck, stablecoins offer predictability and protection that fiat cannot.

Peer-to-Peer Commerce: No Bank Needed

Without a formal bank account, people often rely on:

- Cash-based marketplaces

- Barter systems

- Informal lenders (with exploitative rates)

Crypto flips that model.

Using peer-to-peer platforms like Binance P2P, Paxful, or Telegram-based escrow groups, users can:

- Buy and sell goods directly using crypto

- Pay freelancers or contractors without a middleman

- Send remittances to family abroad — without 30% fees

All you need is a wallet and a signal.

The Rise of Mobile-Only Money

With mobile wallets like MetaMask, Trust Wallet, or even WhatsApp-integrated tools, users can:

- Store savings in stablecoins

- Earn via DeFi or task-based crypto jobs

- Transact with anyone globally

- Avoid corrupt, overreaching financial institutions

Crypto becomes not just a tool — but an alternative financial system.

The Takeaway

While the Web3 world debates L2s, memecoins, and Metaverse land, millions of people are quietly using crypto to escape broken economies.

Stablecoins are replacing banks in places where banks have failed.

Peer-to-peer commerce is replacing institutions with communities.

And the unbanked are finally getting a wallet they can trust — even if it’s not made of leather.

Leave a Reply