Decoding Crypto Fundraising: ICOs, IDOs, STOs, IEOs & Fair Launches Explained

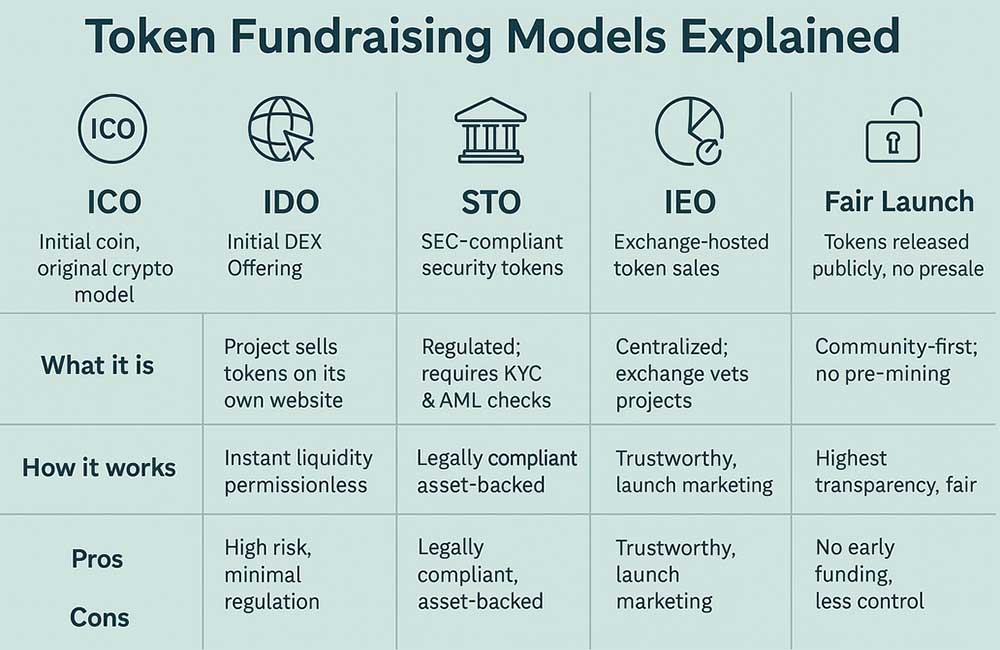

The crypto world moves fast — and so do the ways blockchain projects raise money. From the original ICO boom to today’s decentralized fair launches, token fundraising models have evolved to meet new challenges, regulations, and investor expectations.

But what do all these acronyms actually mean?

Let’s break down the five most common models for launching and funding crypto projects.

1. ICO – Initial Coin Offering

1. ICO – Initial Coin Offering

The original model.

Launched in 2013 with projects like Mastercoin and made famous by Ethereum’s 2014 ICO, this is where it all began.

How it works:

- A project creates a token and sells it directly to early supporters.

- Usually conducted on the project’s website.

- Minimal regulations, high risk/reward.

Pros:

✔ Easy to set up

✔ Broad public access

Cons:

✘ Prone to scams or rug pulls

✘ Often lacks transparency

2. IDO – Initial DEX Offering

The decentralized version of an ICO.

Projects launch their token on a decentralized exchange (DEX) like Uniswap, PancakeSwap, or Raydium.

How it works:

- Token is listed on a DEX with liquidity pairs (e.g., $nftXc/ETH).

- Anyone can buy at launch — usually via a liquidity pool.

Pros:

✔ Instant liquidity

✔ Lower cost, no gatekeepers

✔ Global, permissionless participation

Cons:

✘ Bots can snipe early prices

✘ Volatility right after launch

3. STO – Security Token Offering

The regulated route.

STOs offer security tokens, which represent equity, debt, or real-world assets. They’re subject to financial regulations (like SEC rules in the U.S.).

How it works:

- Investors undergo KYC/AML checks.

- Token must comply with securities laws.

Pros:

✔ Legally compliant

✔ Appeals to institutional investors

Cons:

✘ Slower setup

✘ Less accessible for the average user

4. IEO – Initial Exchange Offering

The centralized approach.

Instead of launching on your own, a crypto exchange (like Binance or OKX) hosts the token sale for you.

How it works:

- The exchange vets the project.

- Users buy tokens directly through the platform.

Pros:

✔ Built-in trust and exposure

✔ Easy for retail investors

Cons:

✘ Exchange takes a big cut

✘ Not decentralized

5. Fair Launch

The community-first model.

No pre-sale, no early investors — just a public token launch where everyone has equal access.

How it works:

- Tokens are released without pre-mining or private sale.

- Often paired with community mining or airdrops.

Pros:

✔ Most decentralized

✔ Transparent and egalitarian

Cons:

✘ No capital raised up front

✘ Less control over distribution

Final Thoughts

Each model has its own strengths, risks, and use cases. Whether you’re launching a project like nftXc.biz, investing in new tokens, or simply trying to understand crypto funding, it’s crucial to know how these models differ.

Some raise capital quickly.

Some prioritize regulation.

Some focus on fairness and decentralization.

No matter which path is chosen, it all ties back to one goal: building the future of blockchain, together.

Leave a Reply