(RWAs) are becoming increasingly popular.

Understanding Real World Assets

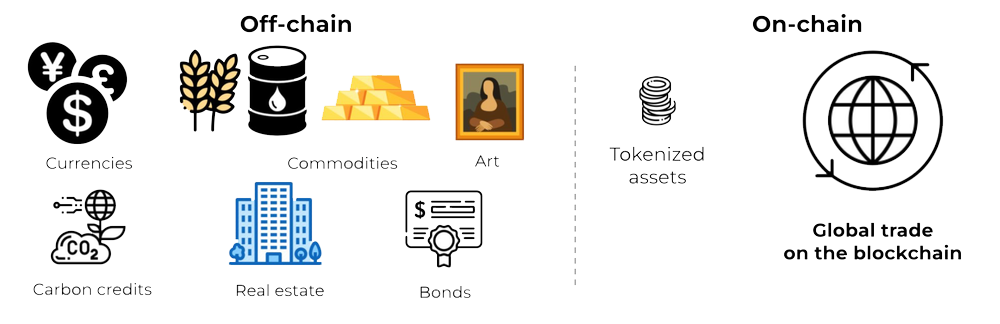

Real-world assets include a diverse range of items, from tangible assets like real estate, commodities, and precious metals to intangible assets like stocks, bonds, and intellectual property. These assets derive their value from outside the blockchain but can be digitally represented through a process called tokenization.

Tokenization involves converting real-world assets into digital tokens that are recorded on the blockchain. This process ensures transparency, security, and immutability. Tokenization also enables fractional ownership, dividing high-value assets into smaller, more accessible units, making it easier for more people to invest and benefit from these assets.

The Role of Real World Assets in the Crypto Space

Real-world assets are increasingly vital in the cryptocurrency space for several reasons:

- Enhanced Liquidity: Traditionally illiquid assets like real estate or fine art can be challenging to buy or sell quickly. Tokenizing these assets makes them more liquid, allowing for faster transactions and broader access to investors.

- Portfolio Diversification: Including real-world assets in a portfolio helps crypto investors hedge against the volatility of purely crypto-native assets. This diversification reduces risk and can provide greater stability.

- Connecting Traditional Finance with DeFi: Real-world assets bridge the gap between traditional finance and decentralized finance (DeFi). DeFi platforms facilitate the lending, borrowing, and trading of tokenized real-world assets, offering opportunities similar to those of traditional financial institutions. This integration expands the functionality of DeFi and brings new participants into the decentralized financial ecosystem.

By incorporating real-world assets, the crypto industry enhances its utility, accessibility, and appeal, paving the way for a more interconnected and versatile financial landscape.

Examples of Real-World Assets in Crypto

Several innovative projects are leveraging blockchain technology to tokenize real-world assets, bringing accessibility and liquidity to traditional investments.

- TravelX: This platform is transforming airline seats into non-fungible tokens (NFTs). Travelers can purchase tickets as NFTs, enabling them to trade or resell these assets on a liquid secondary market. This approach introduces greater flexibility and efficiency in buying and managing travel tickets.

- Ctrl Alt: Focused on diversifying portfolios, Ctrl Alt tokenizes alternative asset classes by partnering with organizations that manage unique investment opportunities. Through fractional ownership represented as digital assets, everyday investors gain access to niche investments that were once out of reach.

- Koibanx: Specializing in tokenizing assets such as real estate and stocks, Koibanx enables users to convert these traditional assets into blockchain-based tokens. This process enhances liquidity and accessibility, making these investments easier to trade.

- Evident: Offering a comprehensive platform for financial activities, Evident supports the creation of Special Purpose Vehicles (SPVs), co-investment opportunities, and tools for capital raising. By enabling asset tokenization, Evident helps companies and investors tap into new funding and investment mechanisms.

- Realio: This platform bridges private equity, real estate, and other real-world assets with decentralized finance (DeFi). Realio provides investors exposure to asset classes typically reserved for accredited or institutional investors, democratizing access to high-value opportunities.

These projects showcase the versatility of tokenized real-world assets, highlighting their potential to revolutionize investment strategies. By bringing liquidity, accessibility, and tradability to traditionally illiquid assets, tokenization is opening new doors for a broader range of investors.

Leave a Reply