Proof of Stake Versus Proof of Work

- Proof of stake is a consensus protocol for verifying cryptocurrency that doesn’t require energy-intensive cryptographic problems. Instead, those who stake the most coins to the network get rewarded with more cryptocurrency. PoS also makes it easier for individuals to earn money.

- Proof of work is a consensus protocol for verifying cryptocurrency that relies on mining to validate transactions. Mining means that computers that are connected to the network race to solve complicated cryptographic puzzles, which is an energy-itensive process.

The U.S. dollar, the Chinese yuan and the European euro all have one thing in common: They’re centralized currencies. They’re issued by a central bank and distributed to the wider public through branch banks.

Technically speaking, no dollar is worth anything. The value of a dollar is determined not by whether you can eat it, drink it, or wear it, but by what you can get in exchange for it. For example, you might be able to buy a small snack for one dollar. One dollar is therefore worth one snack, two dollars are worth two snacks, and so on.

Cryptocurrencies are similar in practice. Back in 2010, a Floridian programmer named Laszlo Hanyecz bought a couple of pizzas for 10,000 Bitcoin. At the time, that’s what Bitcoin was worth. Today, you could buy many more pizzas with this money. 10,000 Bitcoin would roughly equal 200 million dollars at the time of writing this article! The point is, the value of Bitcoin is not determined by the technology itself; it is determined by what you get in exchange for it.

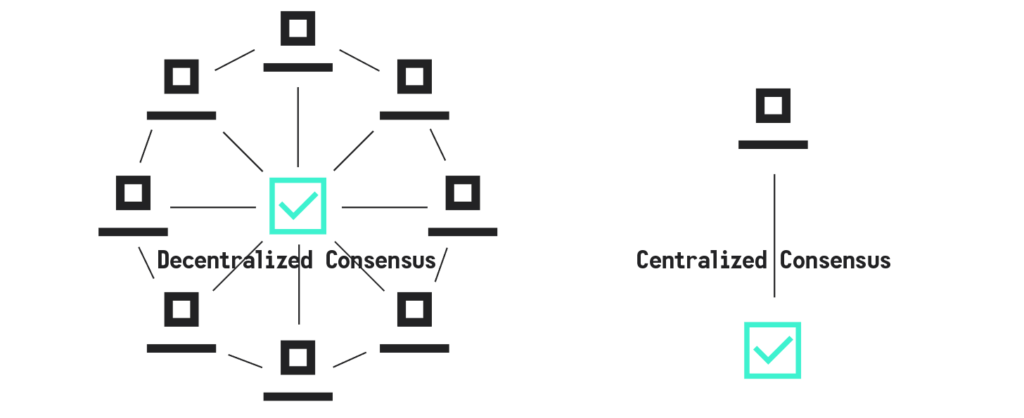

The fundamental difference between Bitcoin or Ethereum and the U.S. dollar is that there is no central bank that issues the former two. Cryptocurrencies are decentralized; that is, no state or other institution is in charge of printing and regulating the money.

There’s just one big problem with this approach: How do we prevent fraudsters from abusing decentralized systems?

As an example, let’s assume that you have 100 Bitcoin. You have seen a nice house in Florida that you’d like to purchase with this money. The house is worth around $2 million dollars, equivalent to 100 Bitcoin. You’re happy and buy the house.

A few months later, you see that the neighboring house is on sale for $2 million. This house is even more attractive than your new one. You don’t want to give up your own house, so you just take the same 100 Bitcoin and buy the neighboring house as well. After all, no bank is watching you!

This so-called double spend problem would destroy all confidence in a currency. If you can buy things worth 200 Bitcoin by spending the same 100 Bitcoin twice, then you might as well buy those things by spending one Bitcoin 200 times. In other words, you would be able to buy anything with tiny amounts of money! Everyone else would do the same, of course, and before long you’d have endless quarrels about what belongs to whom. In the end, people would conclude that the currency isn’t worth anything because it results in fights. The trust has eroded.

With state-issued currencies, the double spend problem doesn’t arise much. States don’t just hand out money; they also have police who can arrest you if you commit fraud.

In decentralized cryptocurrency systems like Bitcoin or Ethereum, however, there are no police. There is no central authority to ensure justice. To avoid the double spend problem, then, one needs something else. A sort of proof that a transaction is valid and that no coin is being spent twice.

In crypto-speak, this kind of proof is generally called a consensus protocol.

Leave a Reply